Tax filing built for traders

Expert tax preparation for active traders. Specialized knowledge. Accurate filings. Simplified process.

Tax Filing Designed Traders

Generic tax software falls short. We expertly navigate the tax complexities of active traders, from day trading to advanced options strategies with precision.

Trader-Specific Accuracy

We understand wash sales, Section 1256 contracts, and mark-to-market elections. Your trades are categorized right the first time.

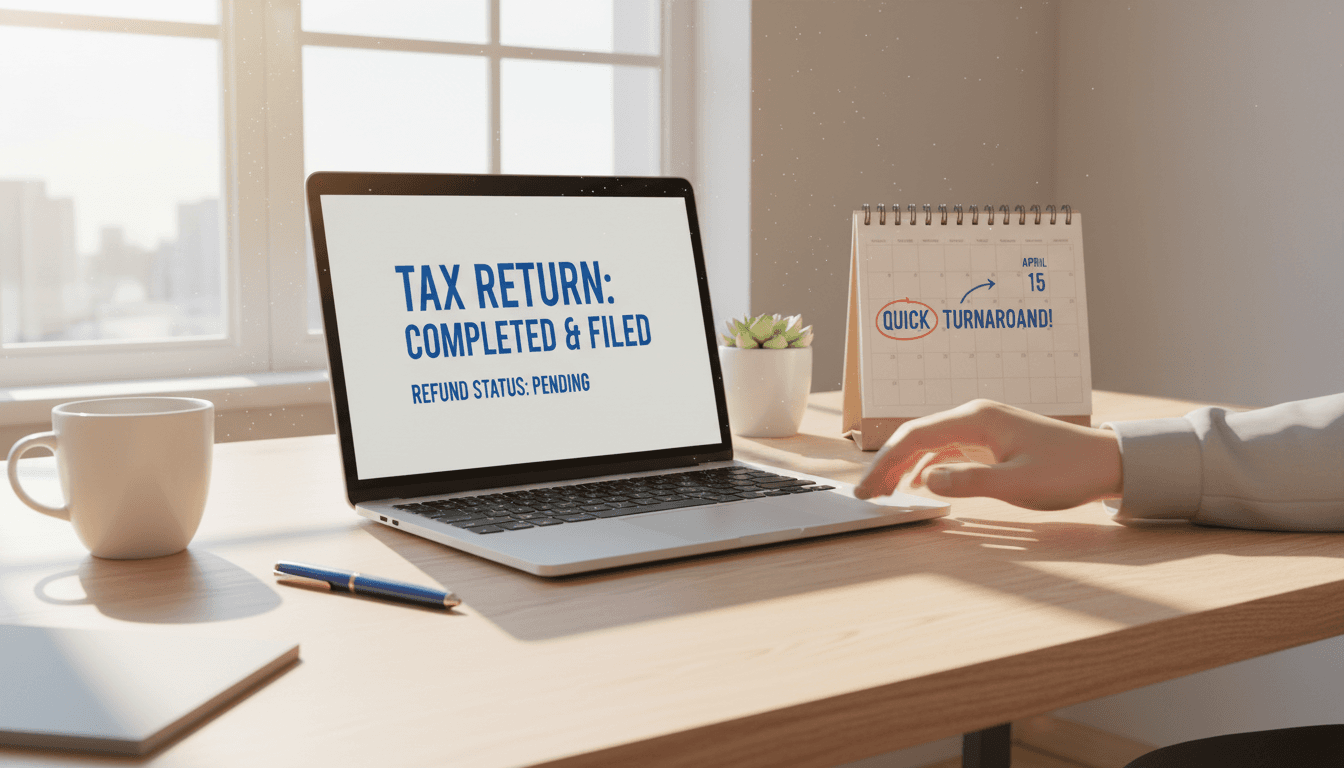

Fast Turnaround

Most trader returns filed within 48 hours of submission. No waiting weeks for callbacks or delayed filings.

Built by Traders, for Traders

Taylor Gartica and our CPA team have filed taxes as active traders. We know your situation from experience, not textbooks.

All Trade Types Covered

Day trading, swing trading, options, crypto, futures, spreads. Whatever your strategy, we file it correctly.

Simple Online Process

Upload your trading records, answer a few questions, done. No paperwork. No in-person meetings needed.

You Stay in Control

Review everything before filing. Ask questions. Request changes. Your return, your final say.

Traders Who Get It Choose BlackLine

See how traders are simplifying their tax filing with a platform built by traders, for traders.

Finally, a tax service that understands day trading. BlackLine handled my wash sales and crypto transactions without treating me like a novelty.

Marcus Reynolds

Day Trader, 8+ years

I spent three years with a generic CPA who didn't get options trading. BlackLine filed my return in half the time and saved me a grand.

Jessica Liu

Options Trader

The platform made organizing my 1099s and reported trades painless. No back-and-forth emails. Just clear filing when tax season hit.

David Carter

Futures Trader

As someone who trades both stocks and crypto, I needed someone who speaks both languages. BlackLine nailed it. Highly recommend.

Amara Okafor

Multi-Asset Trader

Trading income is complicated. My biggest relief was not having to explain my business structure to the accountant. They already knew.

James Hoffman

Swing Trader

BlackLine gets my account statements. They know what a P and L actually means. That alone made this worth it.

Sophia Nakamura

Algorithmic Trader

Real results for active traders

We've helped traders streamline their tax filings with accuracy and speed. From day traders to options strategists, traders rely on BlackLine Tax Group.

1000+

Returns filed

Traders across the US have filed specialized returns through BlackLine Tax Group.

100%

IRS acceptance

Every return we file passes IRS validation. No rejections, no corrections.

2-3 days

Average filing time

From upload to submission, we handle your forms faster than traditional preparers.

98%

Client retention

Traders who file once with us return year after year for reliable, trader-focused service.

Stop struggling with trader tax returns. Start filing with specialists.

BlackLine Tax Group handles the complexity so you can focus on trading. Get your return filed by traders who understand your income, deductions, and strategy.

Built for traders

BlackLine Tax Group was founded by Taylor Gartica to solve a real problem: traders need tax filing that actually understands their world. We combine trading experience with CPA expertise to handle the complexity that generic tax software misses.

Answers about filing with BlackLine

Get clarity on pricing, security, and how we handle trader tax returns.

Who should use BlackLine Tax Group?

BlackLine is built for active traders: day traders, swing traders, options traders, and crypto traders. If you file Schedule C or handle 1099 income with frequent trades, we specialize in your situation. Our platform handles wash sales, cost basis, and trader-specific deductions automatically.

How does BlackLine handle my trading data?

All data is reconciled against your 1099s to identify and resolve missing or duplicate transactions.

Is my data secure with BlackLine?

Yes. We use industry-standard encryption for all data in transit and at rest. Your trading data and tax documents are never shared with third parties. You control what you upload and can delete your information anytime.

What about pricing? Do you charge per return or by trade count?

We price by return, not by trade volume. No matter if you made 100 trades or 10,000, the cost is the same. Exact pricing details are on our services page. We're transparent, and you'll see the full cost before you file.

Can BlackLine file an amended return or prior-year return?

We handle current-year returns. If you need to amend a prior year or file back taxes, contact us directly at 832-272-2492. We'll assess your situation and guide you through next steps.

What's the turnaround time for my return?

Once you submit your completed information and documents, we review within 2-3 business days. If we need clarification, we'll reach out. You'll have your return ready to file or amend within that window.

Schedule a free consultation

Submit your message, and our team will respond promptly.