Tax Filing Built By Traders, For Traders

Specialized tax returns that handle the complexity of trading income, wash sales, and Section 1256 contracts.

Tax Filing Built For Traders

BlackLine Tax Group handles the complexity so you can focus on trading. Specialized expertise, accurate returns, fast processing.

Built by Traders

BlackLine Tax Group was created by traders and CPAs who understand your unique filing needs and trading activity.

Accuracy You Can Trust

Every return is reviewed for accuracy. BlackLine Tax Group ensures your filing is correct and optimized for your trading situation.

Fast Processing

Your completed return is processed quickly so you can file without delay. BlackLine Tax Group prioritizes speed without sacrificing accuracy.

Specialized Knowledge

BlackLine Tax Group understands trader-specific deductions, wash sales, Section 1256 contracts, and other complexities standard accountants often miss.

Support When You Need It

BlackLine Tax Group answers your questions directly. Get support from CPAs who understand your situation, not automated responses.

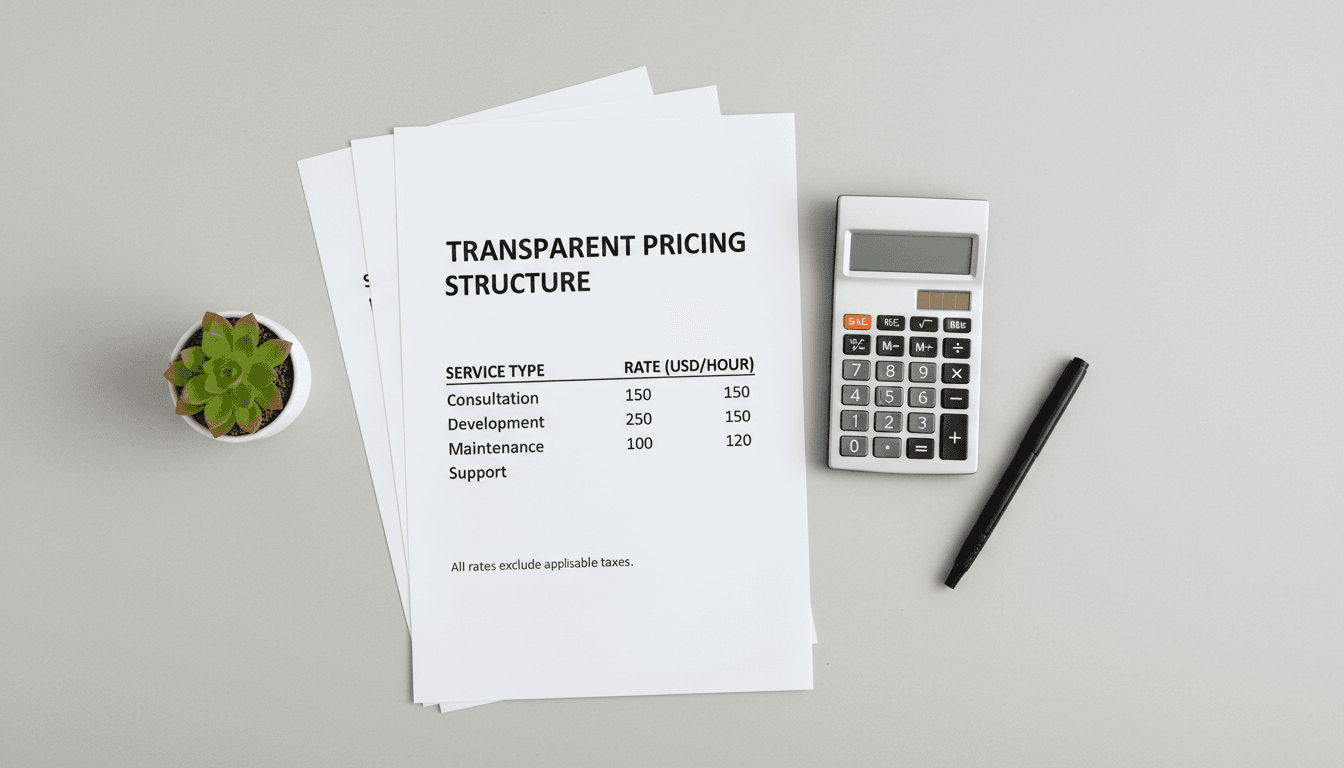

Competitive Pricing

Transparent pricing with no hidden fees. BlackLine Tax Group offers straightforward rates tailored to your filing needs.

Traders Who Switched To BlackLine Tax Group

See why active traders trust BlackLine Tax Group to handle their complex tax filings accurately and on time.

BlackLine Tax Group finally made tax filing simple. They understand day-trader math that other services missed. My returns were filed correctly the first time.

Marcus Webb

Day Trader, Houston TX

As a swing trader, I was always stressed about wash sales and cost basis. BlackLine Tax Group caught details I would've missed. Worth every penny.

Jennifer Park

Swing Trader

The team built BlackLine Tax Group for people like me. They speak trader language and filed my options trades without confusion. Exactly what I needed.

Robert Sanchez

Options Trader

I switched from a big firm because they didn't understand crypto and stock trading together. BlackLine Tax Group handled both seamlessly. Real support when I had questions.

Alexis Turner

Crypto and Stock Trader

Built by traders, for traders

BlackLine Tax Group has helped active traders file accurate returns and keep more of what they earn. Specialized expertise meets straightforward support.

100%

Accuracy focus

Every return reviewed for compliance and optimization specific to trading activity.

1-2 days

Typical turnaround

File your return fast without sacrificing accuracy or missing deductions.

CPAs + Traders

Our team

Expertise from both sides means we understand your situation and your filings.

24/7 Access

Online filing

Upload documents and track progress anytime. No calls required unless you need one.

Common questions about tax filing for traders

Get answers about security, support, timelines, and how BlackLine Tax Group handles your trading taxes.

How does BlackLine Tax Group keep my financial data secure?

We use industry-standard encryption to protect your data in transit and at rest. Your information stays private and is never shared with third parties. We handle sensitive trader tax documents with the same security standards used by financial institutions.

What makes BlackLine Tax Group different for traders?

BlackLine Tax Group was built by traders and CPAs who understand trading income, wash sales, and Section 1256 contracts. We specialize in filing returns for active traders, not general tax services. This focused approach means fewer missed deductions and faster, more accurate filings.

When do I need to submit my trading information?

File by April 15 for the previous tax year, or October 15 if you file an extension. We recommend gathering your trading records by early March to allow time for accurate review and filing. Contact us early in tax season to avoid last-minute delays.

Can BlackLine Tax Group help with estimated quarterly taxes?

Yes. We review your trading income and help you understand quarterly estimated tax obligations. Traders often owe quarterly taxes, and we help calculate what's due to avoid penalties and surprise bills at year-end.

What happens if I have questions after my return is filed?

Email tgartica01@gmail.com with questions or concerns about your return. We respond to client inquiries and provide clarification on your filing. If the IRS follows up, we'll help explain what's on your return.

Do you offer support for IRS audits or inquiries?

BlackLine Tax Group can explain your return and help you respond to IRS questions. For complex audit representation, we can refer you to qualified tax professionals in Houston. Our focus is filing accurate returns that minimize audit risk.

Still have questions?

Send us a message, and our team will get back to you as soon as possible.

Stop Overpaying on Taxes. Start Filing Like a Pro.

BlackLine Tax Group handles the complex filings traders need. File with confidence and keep more of what you earn.